Updated: May 16 – 2025

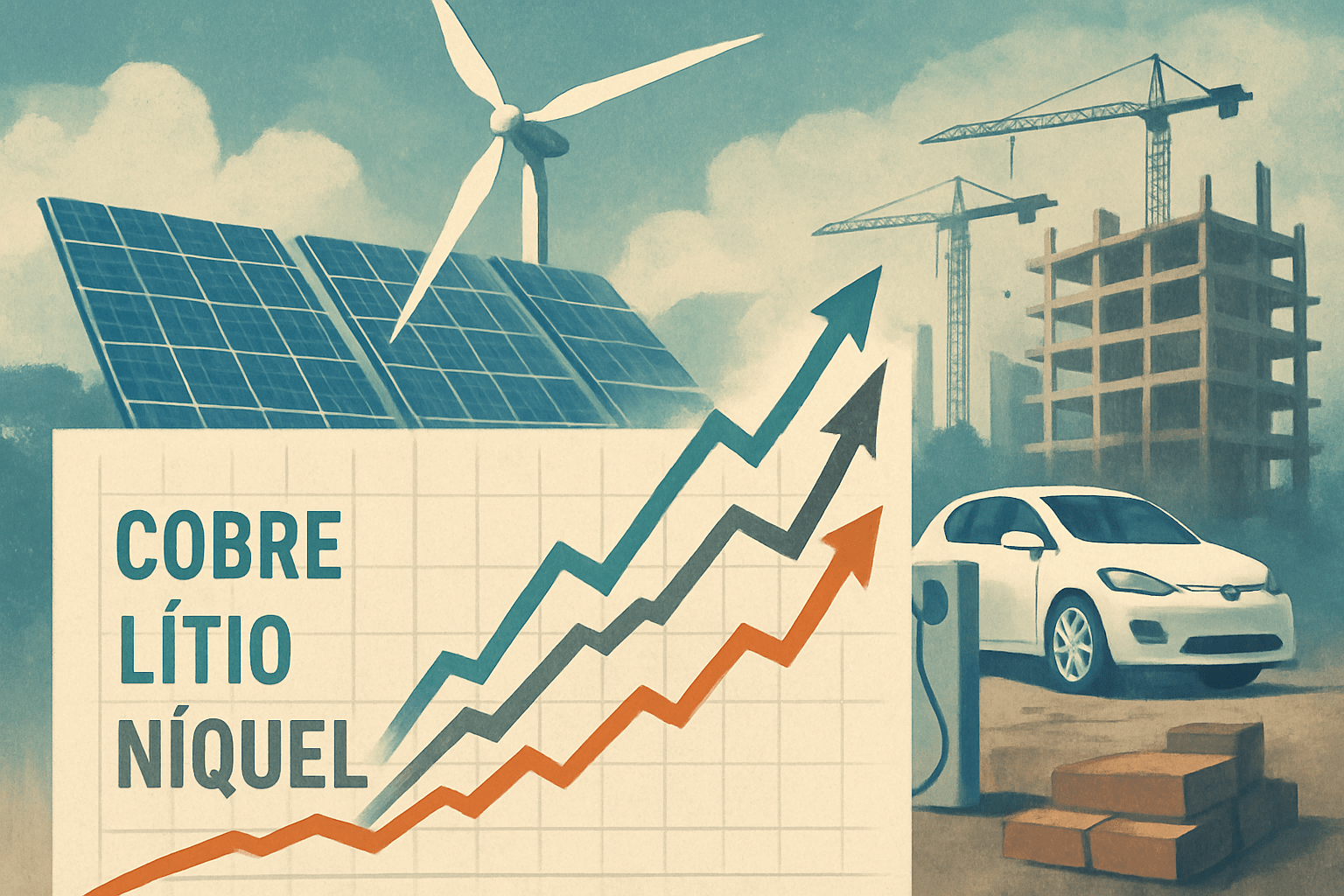

LONDON, UK – Prices for key industrial metals, including copper, lithium, and nickel, have experienced a significant upswing in recent months, driven by a confluence of factors, primarily the global push towards green energy technologies and increased government spending on infrastructure projects.

This heightened demand is outstripping current supply capabilities, leading to concerns about potential shortages and further price inflation in the medium term. Copper, essential for electrical wiring, renewable energy systems like solar panels and wind turbines, and electric vehicle (EV) charging infrastructure, has seen its price approach record highs. Similarly, lithium and nickel, critical components in EV batteries, are facing unprecedented demand as automakers worldwide accelerate their transition to electric mobility.

The supply side has been slow to respond to this demand surge. Opening new mines and expanding existing ones is a capital-intensive and time-consuming process, often hampered by stringent environmental regulations and geopolitical risks in key mining jurisdictions. This supply-demand imbalance is creating a super-cycle dynamic for many industrial metals, with analysts predicting sustained price strength for several years. “The green energy transition is fundamentally a metals-intensive transition,” commented a leading commodities strategist. “We are witnessing a structural shift in demand for these materials that will require massive investment in new supply to meet future needs.” Beyond the energy transition, large-scale infrastructure programs announced by governments in developed and developing economies are also contributing to the demand for industrial metals.

These programs, aimed at modernizing roads, bridges, and public utilities, require substantial quantities of steel, aluminum, and copper. The rising cost of these essential raw materials could, however, impact the overall cost and timeline of these infrastructure projects. Market participants are closely watching inventory levels at major metal exchanges, which have been dwindling, indicating tight market conditions. The situation also presents opportunities for recycling and urban mining initiatives to play a greater role in supplementing primary metal supply. However, the scale of these secondary sources is currently insufficient to bridge the widening supply gap.

The long-term outlook for industrial metals remains bullish, but the path ahead is likely to be characterized by price volatility as markets navigate supply constraints, geopolitical uncertainties, and the evolving pace of the global green energy transition and infrastructure development. Investment in research and development for alternative materials and more efficient extraction and processing technologies will also be crucial in managing the long-term supply challenges for these critical resources needed for a sustainable future.