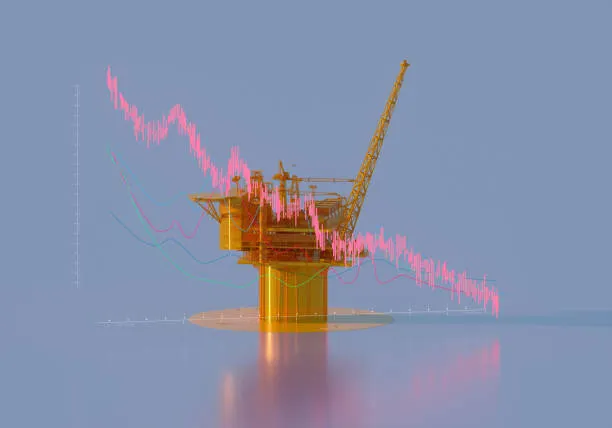

Oil prices continued their downward trajectory on Monday, as escalating trade tensions between the United States and China fueled fears of a global economic slowdown. Brent crude futures fell by 29 cents to $64.47 per barrel, while U.S. West Texas Intermediate (WTI) dropped 27 cents to $61.23, marking a significant decline since early April .

The recent imposition of tariffs by both nations has heightened market volatility. China’s retaliatory tariffs, reaching up to 125% on U.S. imports, have exacerbated concerns over reduced global demand for oil . Additionally, President Trump’s announcement of forthcoming tariffs on imported semiconductors adds to the uncertainty, despite temporary exemptions for certain electronics .

Analysts warn that the prolonged trade dispute could significantly impact the U.S. energy sector. Goldman Sachs projects that Brent crude will average $63 per barrel in 2025, potentially declining to $58 in 2026, while WTI is expected to drop from $59 to $55 over the same period . Such price levels may challenge the profitability of U.S. shale producers, particularly those with higher break-even costs.

For investors, the current landscape suggests caution. The interplay between trade policies and energy prices underscores the importance of monitoring geopolitical developments. Diversifying portfolios and considering exposure to more resilient sectors may be prudent strategies amid ongoing market uncertainties.

Source: Wall Street Journal